REDVERS REPORT: November Market Update

All data is sourced from Altus Data Studio. Readers should verify information before making real estate decisions.

November 2024 revealed contrasting trends in commercial real estate activity compared to November 2023, with significant variations across Oakville, Burlington, Mississauga, Milton, and Brampton. Key highlights include:

Transactional Declines: Burlington, Milton, and Brampton recorded significant drops in activity across multiple asset types.

Oakville Growth: Oakville’s ICI land transactions doubled, with notable activity in residential land as well.

Mississauga Highlights: A sharp decline in industrial activity was offset by ICI land values surging over 600%.

Brampton Retail Surge: Retail property transactions doubled, with significant price appreciation.

Oakville

Oakville displayed mixed performance in November 2024. ICI land transactions doubled from last year, and residential land emerged as a significant segment, with an average selling price of $6.1M. However, industrial, office, and retail property transactions saw little to no activity compared to last year. Industrial prices per square foot increased by 26.49%, indicating resilient demand for existing properties.

Oakville saw 7 transactions last month compared to 4 this month.

Burlington

Burlington experienced a substantial slowdown, with no transactions in apartments, industrial, or retail properties. Office property activity remained steady with one transaction, but average selling prices plummeted nearly 81%. Despite this, the price per square foot nearly doubled, hinting at a higher valuation for premium spaces even amid declining transaction volumes.

Burlington saw 2 transactions last month compared to 1 this month.

Mississauga

Mississauga recorded a sharp contrast in November 2024. Industrial transactions dropped by 62.5%, while office and ICI land activity fell by 83.3% and 50%, respectively. However, ICI land prices rose over 600%, signaling investor interest in strategic development opportunities. Retail properties held steady in transaction volume but saw average prices decline by 30.18%.

Mississauga saw 18 transactions last month compared to 11 this month.

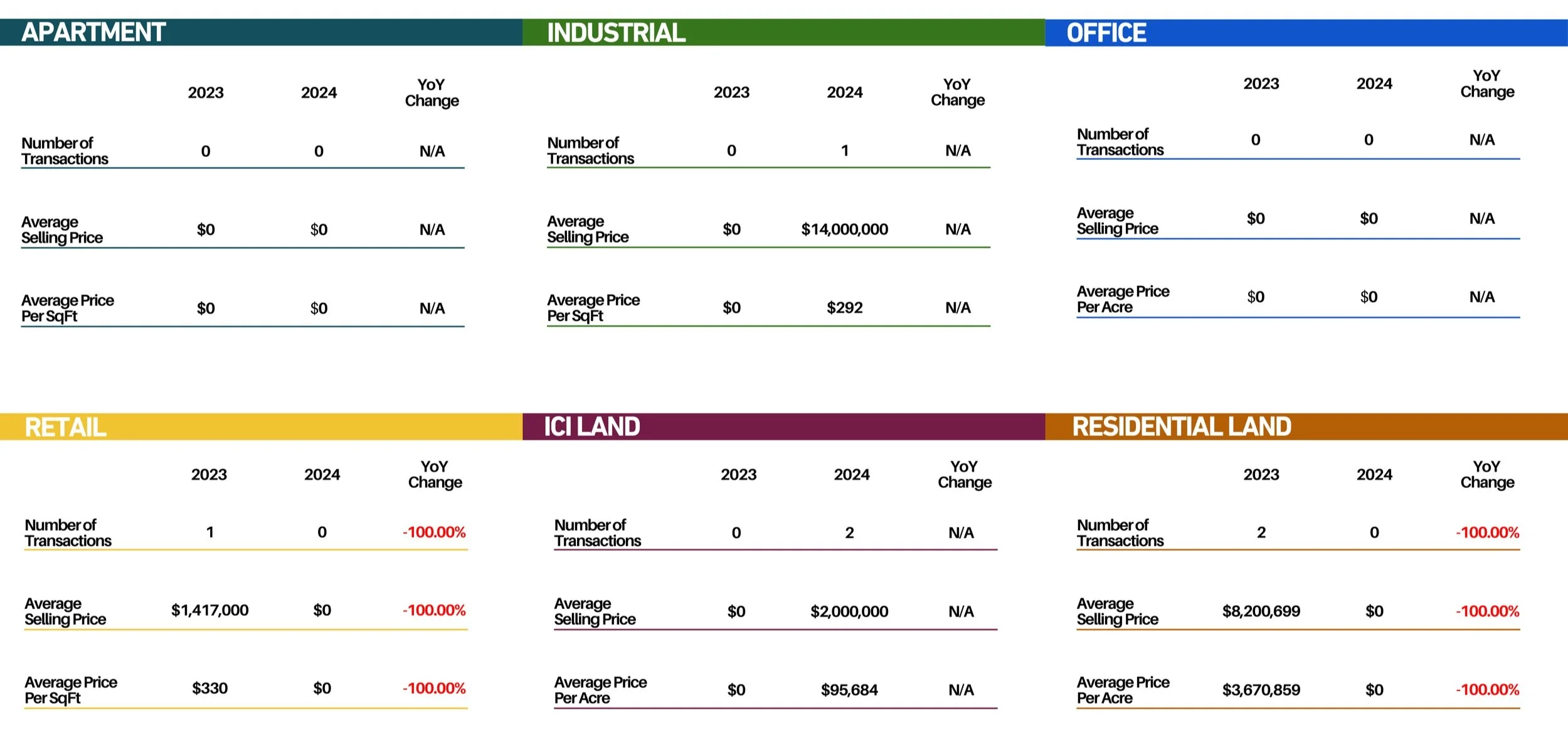

Milton

Milton’s commercial real estate market was relatively quiet in November 2024, with only one industrial transaction recorded. The property sold for $14M, marking the only activity for the area. Other asset types, such as retail and residential land, had no recorded transactions, showcasing a pause in market activity following previous months’ growth.

Milton saw 3 transactions in October compared to 1 this November.

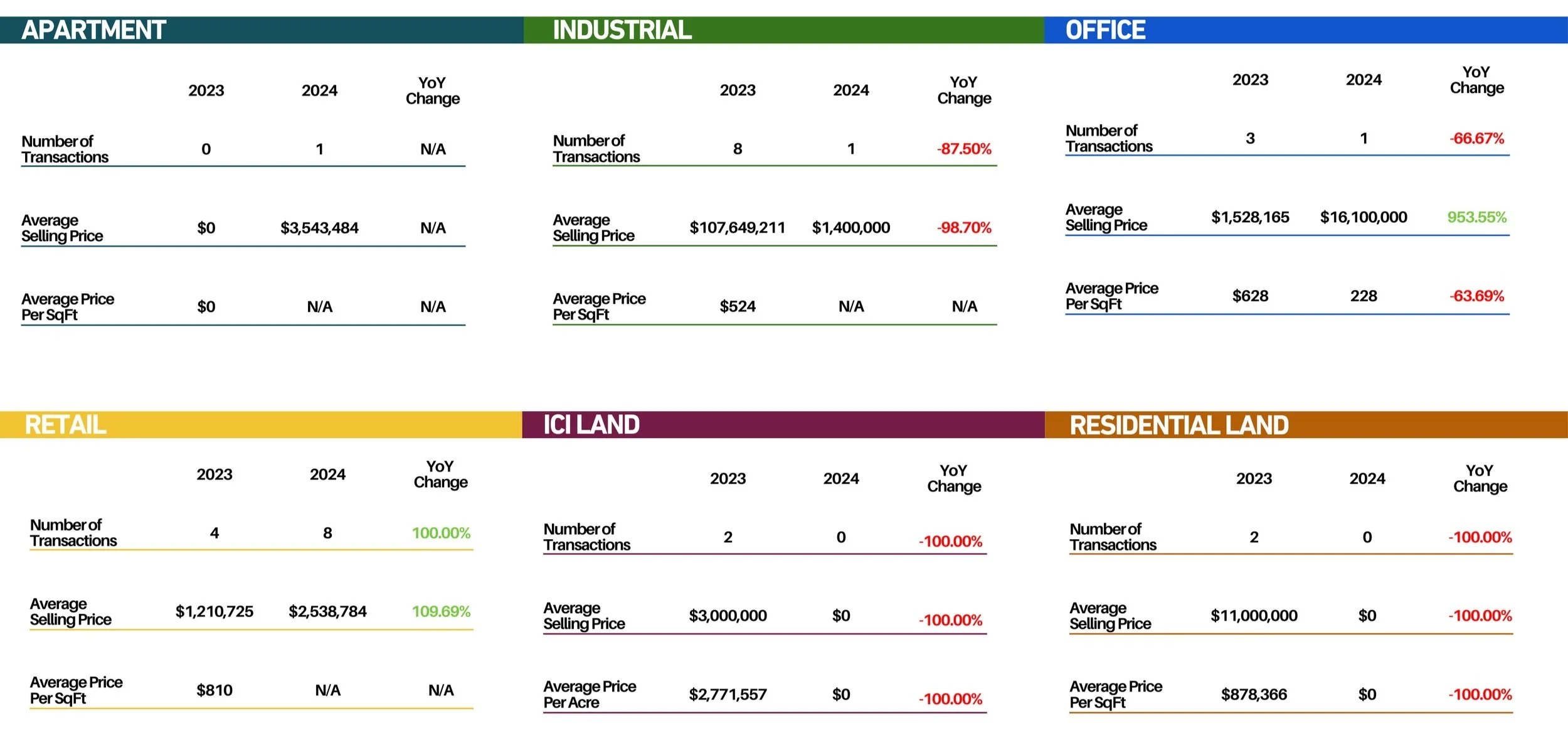

Brampton

Brampton had mixed results in November 2024. While industrial and ICI land transactions saw significant declines, retail property transactions doubled, accompanied by a 109.69% increase in average selling prices. The apartment sector recorded one transaction at $3.5M, indicating renewed but limited interest in multi-residential assets.

Brampton’s commercial market stayed steady with 13 transactions in October compared to 11 this November.