September Market Update

All data is sourced from Altus Data Studio. Accuracy is not guaranteed, and users should verify information before making real estate decisions.

Oakville

In Oakville, the commercial real estate market has experienced a significant reduction in activity from September 2023 to August 2024. Most notably, apartment and retail sectors saw a complete halt in transactions, with a 100% drop. Even in the industrial sector, while there was a 50% increase in transactions, the average selling price dropped by 65%. This indicates that while some interest remains in industrial properties, the overall market demand has weakened, leading to lower prices.

One possible explanation for this trend is the broader economic landscape, which may have affected both local businesses and real estate investment. Although interest rates are declining, they still remain higher than they were pre Covid which has resulted in a slowdown in investor activity in most areas. Also regional economic slowdowns could have deterred potential investors, especially in higher-priced asset classes like apartments and retail spaces. The sharp decline in average selling prices, especially in industrial real estate, suggests that sellers may be adjusting expectations or facing pressure to close deals quickly.

Burlington

The data for Burlington also paints a picture of a highly reduced market, with 100% decreases across all sectors in transaction volume. Apartment, industrial, office, and retail markets showed no activity for August 2024 compared to September 2023. This dramatic shift could signal an economic contraction or a tightening of the market, where property owners may be holding onto assets rather than selling in an unfavorable market.

Factors contributing to this decline might include a shift in business demand or a retraction of investment in the area. The lack of transactions, combined with no recorded sales for 2024, suggests that Burlington may not be attracting new commercial activity, potentially as a result of rising operational costs or reduced demand for space in key sectors such as office and retail.

Mississauga

Mississauga’s market dynamics reveal a contrasting story compared to Oakville and Burlington. The industrial sector remained active, though the number of transactions fell by 33%. Interestingly, the average selling price skyrocketed by 245%, showing strong investor confidence in high-value properties. However, other sectors like office and retail saw dramatic declines, with office transactions dropping by 100% and retail sales down by 75%. This suggests a shift toward industrial spaces as businesses prioritize logistics and warehousing over traditional office or retail spaces.

The surge in industrial prices could reflect Mississauga's strategic importance as a hub for logistics due to its proximity to Toronto and major highways. Meanwhile, the drop in office and retail transactions could be attributed to changing business models post-pandemic, where companies are reducing their reliance on physical office space, and retail is moving online, reducing demand for commercial retail properties.

Milton

Milton’s market remained relatively quiet, with no transactions in apartments, office, or industrial spaces for both September 2023 and August 2024. The only significant movement was in the retail and residential land sectors, where one transaction occurred in each category. The average selling price for retail properties reached $1.35 million, while residential land showed a much higher value at $3.23 million, indicating a potential rise in demand for land development.

Milton’s stability in the land market suggests that this area will continue to be a great place for developers, likely driven by the town’s growth prospects. The absence of activity in other sectors, however, could be tied to a lack of available commercial inventory or developers waiting for more favorable market conditions before proceeding with larger commercial projects.

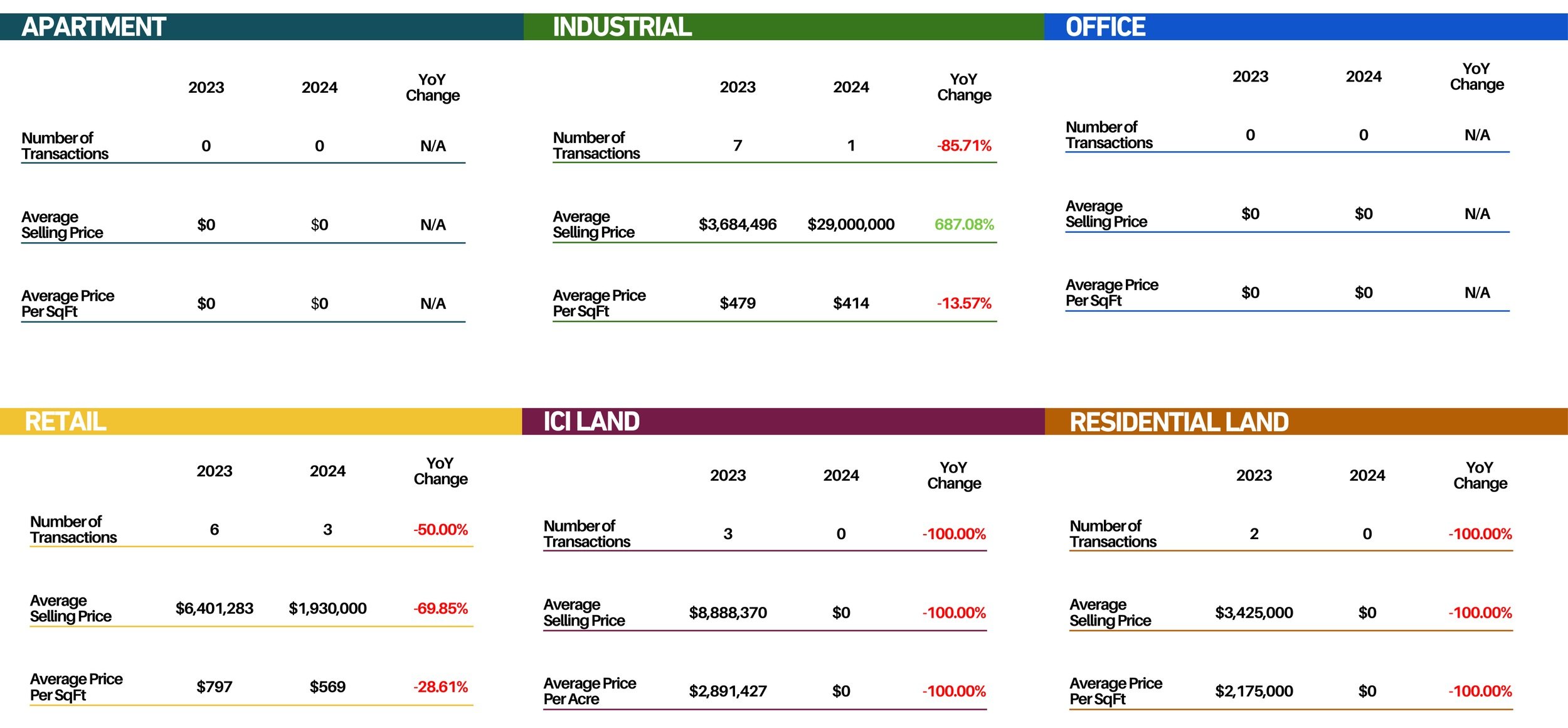

Brampton

Brampton’s commercial real estate market has seen a mixed performance this September. The industrial sector saw a significant 85% drop in transactions, with the average selling price increasing by a staggering 687%. This massive price spike suggests a focus on high-value, large-scale transactions despite fewer deals. Retail also saw a 50% drop in activity, with prices falling by almost 70%. The data indicates a volatile market, where select large transactions skew the overall perception of the market’s health.

The high demand for industrial properties in Brampton could be tied to the city's continued growth as a major industrial hub. However, the decline in retail and the lack of other types of commercial real estate transactions reflect a broader trend where commercial activity is consolidating into fewer, higher-value properties, potentially due to economic pressures or changing investor priorities.